How do enterprise finance teams make decisions? The stereotype is that they start by saying no.

All jokes aside, finance teams and how they make decisions is a hot topic with the shifting market and increased enterprise focus on cutting costs and moving to profitability. Finance teams globally have had to make some difficult calls.

In May, Alteryx released original research about how enterprises use technology to make decisions. We surveyed 2,800 enterprise business decision-makers that work with data in 12 countries globally.

We looked at the data and pulled out the answers of respondents working in finance departments to see how their responses measured up against the global total. We saw an interesting division – finance professionals value speed but are hesitant to commit to automation. Is this creating more challenges in effective decision-making? Let’s break it down.

The Need for Speed

The global decision intelligence results ranked two factors as the top decision-making requirements – confidence (73%) and accuracy (72%). This didn’t hold true for respondents who work in finance departments – instead, confidence (77%) and speed (74%) were the two most important considerations for decision-making.

Why speed? Most likely, this is due to the evolving nature of the role and extension of stakeholders’ CFOs support that expect faster responses – both externally, such as investors, regulators and customers, and internally, including Board members and business leaders. With increased pressures on finance teams and an ever-changing market landscape, deciding confidently and quickly allows you to move on to solving the next problem and pivot when the market throws you another economic disruption.

But why speed over accuracy? That depends on how you define accuracy, and for what decisions. For many macro-level decisions, it’s typically sufficient to have confidence in directional views based on the information at hand, which may allow +/-5% accuracy in numbers. Consider deciding whether to launch a new product or enter a new market. For more micro-level decisions, that buffer for accuracy may be a lot narrower. Consider pricing decisions in the retail market, where a lack of attention to price sensitivity may lead to a loss of customers or redundancy in product lines.

CFOs must balance steering the business, reducing costs and meting regulatory requirements – whilst ensuring finance can meet future stakeholder demands.

Hesitancy Around Automation

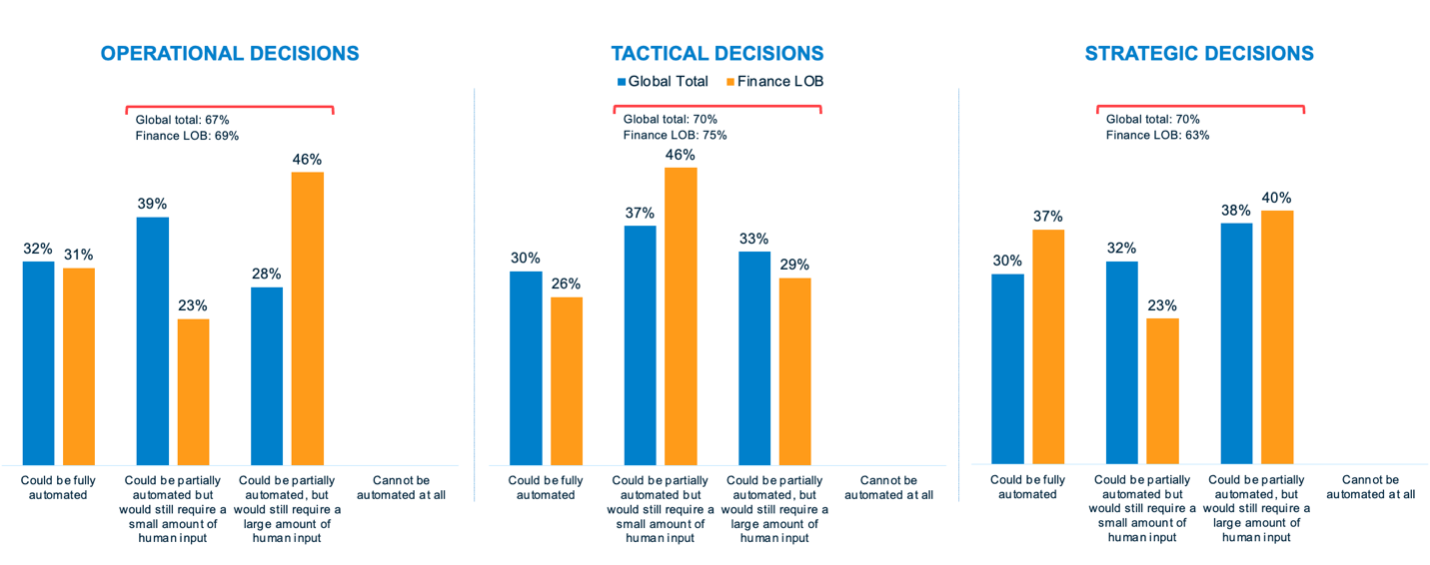

Although the finance employees surveyed were still largely on board with automating decision-making to some extent, overall, they felt that human input would be more necessary for making all types of decisions compared to the global total. (Figure 1)

Figure 1 – To what extent do you believe each of the following decisions could be automated in your organization?

They also felt that humans should be more involved in the future of decision-making than the larger global respondent group; 26% of finance professionals felt that decisions should be human-led, versus 17% for the global respondent group. (Figure 2)

Figure 2 – And finally, what should the role of the human be in the future of decision-making?

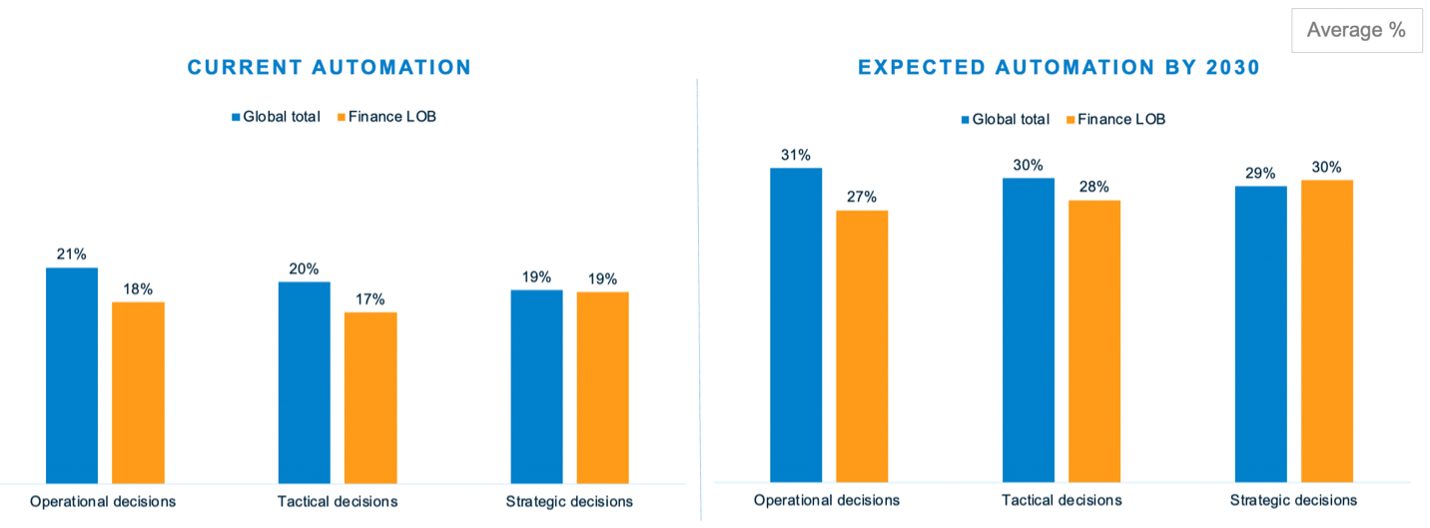

We also see this play out in the data about how automated finance departments are currently. Finance team members were less likely to update their analysis multiple times daily (9%) than the global group (15%). They were also less likely to use automation to update their datasets and analyses (Figure 3).

Figure 3 – Do you have to manually refresh your datasets and/or update your analyses, or is this automated?

Finance teams were less likely to think the future of their field will be automated, with expected automation by 2030 coming in slightly lower than the global totals. (Figure 4)

Figure 4 – What proportion of each of the following types of decisions made in your organization are currently supported by automation, and what do you believe this proportion will be in 2030?

While there’s a lot of scary talk about large language models (LLMs) and generative AI taking jobs or fundamentally shifting industries, the lack of automation in finance departments may be due to a different cause. Finance teams must manage data from various disparate systems, from ERP, allocation engines, visualizations, it goes on. The complexity of data sources combined with the need for speed and management of relationships means that finance teams may just not have the time they need to put it into practice.

There could also be an element of distrust. In finance, the repercussions of good or bad decision-making impact the bottom line, and finance leaders are largely held accountable. Therefore, they may be reluctant to remove the human element to make the best decision and reduce risk.

Over-reliance on Spreadsheets?

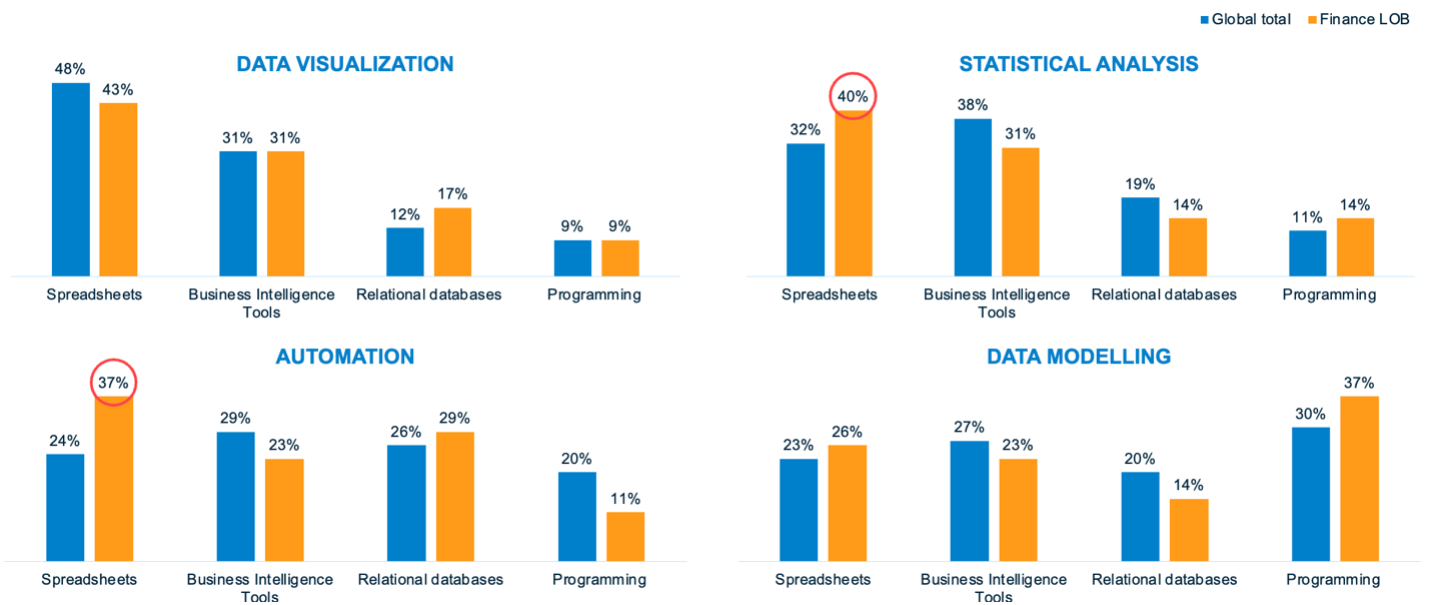

Another hint into why finance team members are slow to automate may lie in the tools they are using. While across global totals, there is a strong reliance on spreadsheets for advanced analytical functions, finance teams had an even stronger dependence. Across data visualization, statistical analysis, and automation functions, spreadsheets were the most reported tool used by finance teams.

Figure 5 – What level of technology do you most commonly personally use to complete tasks in each of these areas?

This makes sense, in a stereotypical sense; Excel has been a popular tool in finance departments, and it is often the default solution to connecting multiple data sources. Finance teams are a bit stuck here — they need to move fast but are dealing with multiple systems that don’t talk to one another — so Excel has become the go-to option. But it’s possible that using Excel across so many different analytical applications is holding finance teams back from reducing repetitive tasks and saving time. BT Group, a telecommunications and network provider in the UK, had a legacy Excel system that relied on 140 models to run its regulatory processes. Only by adopting more automated tools were they able to free up their team’s time to focus on more strategic problem-solving and planning.

The Changing Role of Finance

These insights point to a decision division in finance teams: there’s a clear need for speed and confidence in decisions that are being made, but there’s also a hesitation in adopting the tools and approaches to make decisions faster and more confidently.

The finance function is evolving from so much more than just the owner of financial success and profitability. Finance leaders are now expected to:

- Drive growth and profitability.

- Build resilience in resourcing and supply chains through management and planning.

- Drive and scale digital and business transformation.

- Identify, integrate, and plan for market risks.

- Accelerate, track, and report on ever-evolving compliance and regulatory issues.

As the finance function becomes more complicated, automation could promote a healthy balance between speed and confidence in decision-making. Perhaps this all comes down to semantics – maybe automation is the wrong word – instead, finance teams should consider human augmentation through technology as a solution. It will build the capacity needed to reduce manual, repetitive tasks so that teams can focus on higher, more strategic decisions.

What’s Next?

READ: The Decision-Making Technologies Shaping the Future of the Enterprise

Ready to get started? Contact Alteryx.